Executive Summary

The Indian pharmaceutical cold chain sector is currently navigating a period of unprecedented transformation, characterized by the simultaneous convergence of stringent regulatory deadlines, rapid technological advancements, and shifting market dynamics. As the industry approaches the fiscal and calendar milestones of 2026, it faces a definitive “compliance cliff” driven by the revised Schedule M guidelines and new energy efficiency mandates from the Bureau of Energy Efficiency (BEE). These regulatory frameworks are not merely administrative hurdles; they represent a fundamental restructuring of the industry’s operating model, mandating a transition from legacy, fragmented infrastructure to integrated, data-driven, and quality-assured cold chain systems.

By 2026, the Indian cold chain market is projected to be in the midst of a robust expansion, with the broader market expected to reach USD 74.5 billion by 2033, growing at a CAGR of 24.7%. This growth is propelled by India’s cementing status as the “Pharmacy of the World,” a title that now encompasses not just generic oral solids but increasingly complex biologics, vaccines, and gene therapies. The operational imperative has shifted from volume to value, necessitating infrastructure that offers precision, reliability, and real-time visibility.

This comprehensive research report provides an exhaustive analysis of the pharmaceutical cold storage landscape in India for the year 2026. It dissects the macroeconomic drivers, the intricacies of the new regulatory regime, the emergence of “Cold Chain 4.0” technologies, and the critical role of specialized infrastructure providers like Rinac India Limited. The analysis posits that 2026 will be the year of separation, where compliant, tech-enabled players consolidate their market leadership, while traditional, non-compliant entities face existential risks.

-

The Macro-Economic Landscape: Growth, Exports, and the Value Shift

The trajectory of the Indian pharmaceutical cold chain is inextricably linked to the broader economic performance of the healthcare sector and the nation’s strategic position in global supply chains. The period leading up to and including 2026 is defined by a departure from linear growth to exponential value creation, driven by specific market catalysts.

1.1 Market Valuation and the 2033 Horizon

Statistical forecasting reveals a market undergoing aggressive expansion. While the immediate focus is on 2026, the investment decisions made today are predicated on long-term horizons. The Indian cold chain market, encompassing both pharmaceutical and food logistics, generated a revenue of approximately USD 10.46 billion in 2024. By 2033, this figure is projected to surge to USD 74.5 billion, representing a massive sevenfold increase.

Within this aggregate, the pharmaceutical cold chain logistics segment is carving out a distinct, high-value niche. In 2024, the specialized logistics market for pharmaceuticals was valued at USD 0.57 billion. Estimates suggest this will grow to USD 0.80 billion by 2033, exhibiting a steady CAGR of 3.20%. However, analysts argue that this specific logistics figure significantly underrepresents the true scale of the opportunity. It captures the service revenue but does not fully account for the massive capital expenditure (CAPEX) required for infrastructure development—the construction of GMP-compliant cold rooms, the procurement of reefer vehicles, and the deployment of IoT networks—which constitutes the tangible asset base of the industry.

This divergence between the service market growth (linear) and the overall cold chain market growth (exponential) suggests a massive influx of investment into storage capacity and infrastructure assets rather than just transport services. The demand is for “static” cold chain (warehousing) as much as “mobile” cold chain.

1.2 The Strategic Pivot: From Generics to Biologics

For decades, the Indian pharmaceutical industry was synonymous with small-molecule generics—chemically synthesized drugs that are relatively stable and often require only ambient or air-conditioned storage. The landscape for 2026 is markedly different. The industry is aggressively pivoting toward large-molecule biologics, monoclonal antibodies, biosimilars, and gene therapies.

This shift changes the physics of storage. Unlike chemical pills, biologics are protein-based and inherently unstable. They are susceptible to denaturation if temperatures deviate even marginally from the prescribed range, typically 2°C to 8°C. Furthermore, the burgeoning field of mRNA vaccines and cell therapies requires ultra-low temperature (ULT) storage, ranging from -20°C down to -80°C.

The implication for cold storage infrastructure is a move from “comfort cooling” to “precision process cooling.” The high-value ingredients (APIs) used in these modern formulations are prohibitively expensive; a single pallet of a monoclonal antibody can be worth more than the entire warehouse storing it. Consequently, the tolerance for risk has evaporated. Manufacturers are no longer looking for the cheapest cold room; they are seeking validated, redundant systems that guarantee stability. This has spurred demand for specialized equipment like Rinac’s stability chambers and ultra-low temperature freezers, which are engineered to maintain tight thermal bands regardless of external ambient conditions.

1.3 Export Dynamics and Geopolitical Tailwinds

India’s role in the global pharmaceutical supply chain is expanding under the geopolitical strategy known as “China Plus One.” Global pharmaceutical giants are actively seeking to diversify their manufacturing bases to mitigate risks associated with over-reliance on a single geography. India, with its established regulatory framework (US FDA approved plants) and skilled workforce, is the primary beneficiary.

Pharmaceutical exports from India rose by 7.22% to reach USD 2.57 billion by September 2024. This export volume is not merely a logistical challenge; it is a compliance challenge. Developed markets, particularly the United States and the European Union, enforce stringent Good Distribution Practices (GDP). For an Indian manufacturer to export a temperature-sensitive drug to Europe, the domestic leg of the journey—from the factory in Hyderabad to the port in Mumbai—must meet the same rigorous standards as the international leg. This “export-backwards” pressure is forcing Indian companies to upgrade their domestic cold chain infrastructure to global standards, creating a market for high-spec solutions provided by companies like Rinac.

Furthermore, potential tariff wars, such as the predicted 15% tariff on branded medicines imported from Europe to the US in 2025, could redirect significant manufacturing volumes to India, provided the country can demonstrate supply chain resilience. This places the cold chain operator in the role of a strategic enabler of international trade.

-

The Regulatory Watershed: The 2026 Compliance Cliff

The year 2026 is not an arbitrary date; it is a regulatory horizon line. Multiple government mandates are converging to create a “compliance cliff” that will force the modernization of the sector. The era of voluntary compliance is ending; the era of mandatory adherence has begun.

2.1 The Revised Schedule M: A Non-Negotiable Imperative

The most significant regulatory driver is the revision of Schedule M of the Drugs and Cosmetics Rules, 1945. The Central Drugs Standard Control Organisation (CDSCO) has set January 1, 2026, as the absolute deadline for compliance for all pharmaceutical manufacturers, specifically targeting Micro, Small, and Medium Enterprises (MSMEs) who were granted an extension until the end of 2025.

The revised Schedule M is designed to harmonize Indian manufacturing standards with the World Health Organization’s Good Manufacturing Practices (WHO-GMP). For the cold storage segment, the implications are profound and specific:

-

Validation and Qualification: It is no longer sufficient to install a cooling unit and turn it on. The revised norms mandate a rigorous qualification process: Installation Qualification (IQ), Operational Qualification (OQ), and Performance Qualification (PQ). Cold rooms must be mapped thermally to identify “hot spots” and “cold spots” under full-load and empty-load conditions.

-

Data Integrity and ALCOA+: The manual recording of temperature data on clipboards is strictly prohibited. The regulation demands automated, tamper-proof data acquisition systems that comply with the principles of ALCOA+ (Attributable, Legible, Contemporaneous, Original, and Accurate). This necessitates the integration of digital data loggers and SCADA systems that can store historical data securely, a feature central to Rinac’s “RinCare” offering.

-

Segregation and Cross-Contamination: The revised schedule places immense emphasis on preventing cross-contamination. Storage areas must be designed to allow for the strict segregation of different categories of materials (raw materials, finished goods, rejected goods, recalled goods). This drives the demand for modular cold rooms that can be compartmentalized, rather than large, open-plan warehouses.

-

Air Handling and Hygiene: Storage areas for open products require specific air quality standards. This implies the use of HVAC systems with appropriate filtration (HEPA) and air change rates. Rinac’s expertise in “Clean Modular Construction” using coved panels and flush doors directly addresses the hygiene and sanitation requirements of the new Schedule M.

Failure to meet these standards by the January 2026 deadline is not a matter of a fine; it poses the risk of license suspension and factory closure. This existential threat is driving a massive wave of retrofitting and new construction across the MSME pharma sector.

2.2 BEE Star Labeling: The Energy Efficiency Mandate

Parallel to the quality mandates, the Ministry of Power, through the Bureau of Energy Efficiency (BEE), is enforcing strict energy consumption norms. Effective January 1, 2026, revised star rating tables for deep freezers and commercial refrigeration equipment will come into force.

This policy change has two major impacts:

-

Market Prohibition: Manufacturers cannot sell non-compliant, inefficient refrigeration units after the deadline. This effectively bans the sale of low-cost, energy-guzzling “white market” equipment, forcing pharmaceutical companies to purchase higher-rated (and often higher-cost) efficient units.

-

Operational Savings: While the upfront cost of 5-star rated equipment is higher, the operational savings are significant. Given that energy constitutes a major portion of a cold store’s operating expense (OPEX), the BEE mandate inadvertently improves the financial sustainability of cold chain operators in the long run.

Table 1: Regulatory Convergence in 2026

| Regulatory Framework | Effective Deadline | Key Requirement | Impact on Cold Infrastructure |

|---|---|---|---|

| Revised Schedule M (CDSCO) | Jan 1, 2026 | WHO-GMP Alignment | Mandates validated, automated, and segregated storage; eliminates manual logging. |

| BEE Star Rating (Revised) | Jan 1, 2026 | Enhanced Energy Efficiency | Bans sale of inefficient freezers; pushes market toward inverter technology and better insulation. |

| Indian Pharmacopoeia 2026 | 2026 Edition | Blood Component Standards | Introduces strict quality and storage monographs for blood/plasma, affecting hospital cold banks. |

| Global GDP (EU/US) | Ongoing | Supply Chain Integrity | Exporters must prove “end-to-end” temperature control, driving demand for active tracking. |

2.3 Indian Pharmacopoeia (IP) 2026 and Blood Safety

The upcoming 2026 edition of the Indian Pharmacopoeia introduces a critical new dimension: specific general chapters and monographs for blood and blood components. Historically, blood bank storage was governed by general guidelines. The inclusion of specific monographs in the IP gives these standards legal weight.

This will necessitate a review of infrastructure in hospital blood banks and plasma fractionation centers. The storage of Fresh Frozen Plasma (FFP) and Cryoprecipitate requires reliable temperatures below -30°C or -40°C. The IP 2026 standards will likely drive the replacement of consumer-grade deep freezers in hospitals with medical-grade, validated plasma freezers and blast freezers, ensuring that life-saving biologicals are not compromised by equipment variability.

-

The Science of Storage: Thermodynamics and Infrastructure

To understand the shift in the market, one must understand the underlying engineering. The transition in 2026 is from “storage” to “thermal management.” This involves sophisticated choices regarding insulation materials, refrigeration cycles, and construction techniques.

3.1 The Primacy of Insulation: PUF vs. The Rest

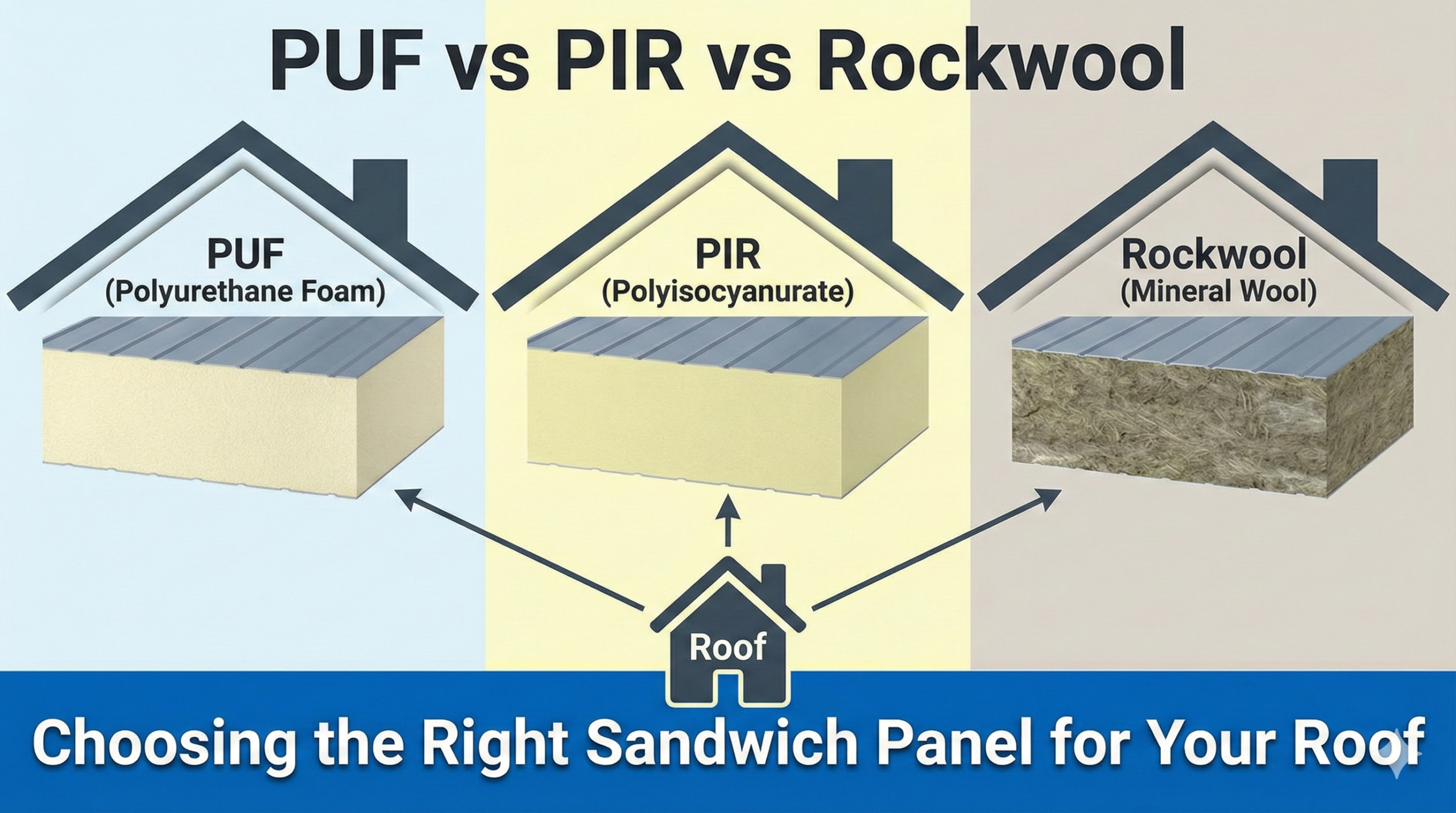

In a tropical country like India, where ambient temperatures can exceed 45°C, the insulation envelope is the first line of defense. The industry standard has decisively shifted to Polyurethane Foam (PUF) and Polyisocyanurate (PIR) panels, moving away from traditional masonry or Polystyrene (Thermocol).

-

Thermal Conductivity (K-Value): High-quality PUF panels typically have a thermal conductivity of roughly 0.022 W/mK, compared to 0.035 W/mK for polystyrene. This 40% difference in efficiency means that for the same wall thickness, a PUF panel blocks significantly more heat. In operational terms, this translates to a reduced load on the refrigeration compressor, leading to lower electricity bills.

-

Thermal Inertia: Density matters. Rinac utilizes high-density PUF (40 kg/m³ ± 2). This density provides “thermal inertia.” In the event of a power failure—a common occurrence in Indian industrial zones—a cold room built with high-density PUF will hold its temperature for significantly longer than one built with lower-density alternatives. This “holdover time” is a critical safety buffer for pharmaceutical products.

-

Fire Safety: The adoption of PIR (Polyisocyanurate) panels is accelerating due to insurance mandates. Unlike standard PUF, PIR creates a char layer when exposed to fire, preventing the spread of flames. Rinac’s FM-Approved panels meet international fire safety standards (Class 1 exterior wall systems), which is increasingly a requirement for multinational pharma clients.

3.2 Clean Modular Construction

Pharmaceutical storage is not just about cold; it is about “clean.” The revised Schedule M emphasizes hygiene. Rinac’s “Clean Modular Construction” approach utilizes pre-fabricated sandwich panels with specific characteristics tailored for this compliance:

-

Surface Finish: Panels are laminated with Pre-Coated Galvanized Iron (PCGI) or Stainless Steel (SS304) with a food-safe, non-dusting coating (typically RAL 9002 White). This surface is resistant to harsh cleaning agents used in pharma sanitation protocols.

-

Joint Geometry: The panels use a “cam-lock” or tongue-and-groove system that ensures an airtight seal. Crucially, the internal corners are finished with coving (curved flashings) to eliminate sharp 90-degree corners where dust and bacteria typically accumulate. This “crevice-free” design is a hallmark of GMP-compliant facility design.

3.3 Refrigeration Architecture: The Move to Green

The “heart” of the cold room—the refrigeration unit—is also evolving.

-

Low RH Technology: Standard air conditioning cools air but often leaves it humid. For hygroscopic pharmaceuticals (effervescent tablets, lyophilized powders), moisture is as damaging as heat. Rinac’s Low Relative Humidity (LRH) Chambers employ specialized desiccant rotors or modified refrigeration cycles (reheat systems) to strip moisture from the air, maintaining RH levels below 30% or 40% independently of temperature. This decoupling of temperature and humidity control is a sophisticated engineering capability essential for modern stability testing.

-

Natural Refrigerants: With the Kigali Amendment to the Montreal Protocol phasing out HFCs (like R-404A), the market is slowly shifting toward natural refrigerants. Ammonia (NH3) remains the king of efficiency for large integrated warehouses due to its superior thermodynamic properties, despite its toxicity risks. For smaller units, Carbon Dioxide (CO2) and Hydrocarbons (R-290) are emerging as eco-friendly alternatives. Rinac supports both Freon and Ammonia platforms, allowing clients to balance safety, efficiency, and environmental goals.

-

The Cold Chain 4.0 Revolution: From Passive to Predictive

By 2026, technology in the Indian cold chain will have graduated from being an optional “add-on” to an operational necessity. This evolution, termed Cold Chain 4.0, integrates the physical infrastructure with digital intelligence.

4.1 IoT and the Death of “Blind Spots”

Historically, temperature monitoring involved passive data loggers—USB sticks placed in a truck that were read only after the shipment arrived. If an excursion occurred, it was discovered too late to save the cargo. 2026 marks the dominance of Active IoT.

-

Real-Time Telemetry: Modern systems use NB-IoT (Narrowband IoT) or LoRaWAN networks to transmit temperature, humidity, door status, and shock data in real-time to the cloud. This allows for immediate intervention. If a cold room door is left ajar, an alert is sent to the facility manager’s phone instantly via apps like Rinac’s RinCare.

-

Granularity: The monitoring is moving from the “vehicle level” to the “package level.” Smart labels and pallet sensors ensure that the specific conditions of a high-value carton are tracked, distinct from the ambient temperature of the truck.

4.2 Artificial Intelligence and Predictive Analytics

The massive influx of data from these sensors is fueling AI-driven insights.

-

Predictive Maintenance: Instead of fixing a compressor when it fails (breakdown maintenance), AI algorithms analyze vibration signatures and power consumption patterns to predict failure before it happens. A deviation in the compressor’s acoustic signature might trigger a maintenance ticket weeks before the unit actually stops cooling. This “zero downtime” approach is non-negotiable for storing high-value biologics.

-

Route Optimization: AI tools analyze historical traffic, weather, and road condition data to route reefer trucks through paths that minimize thermal load. For example, a route might be physically shorter but have high traffic congestion that exposes the truck to prolonged solar radiation; the AI would suggest a longer, faster, cooler route. Companies utilizing such AI systems have reported reductions in temperature deviations by up to 78%.

-

Strategic Product Segments: The Rise of Specialized Chambers

The market is segmenting based on the complexity of the product being stored. The “general purpose” cold room is being supplemented by highly specialized chambers.

5.1 Stability Chambers

Pharmaceutical development requires rigorous stability testing to determine shelf life. This involves storing drug samples under varied conditions of temperature and humidity (e.g., 25°C/60% RH, 40°C/75% RH) for months or years. Rinac’s stability chambers are engineered for this specific purpose, featuring:

-

Uniformity: Precise airflow design to ensure temperature uniformity across the entire volume of the chamber.

-

Redundancy: Dual refrigeration systems and UPS backup to ensure the test is never interrupted, as a single interruption can invalidate a year-long study.

-

Compliance: Integrated data acquisition systems that meet 21 CFR Part 11 requirements for electronic records, essential for FDA audits.

5.2 Blast Freezers and Quick Freezing

For blood plasma and certain biological precursors, the speed of freezing is critical. Slow freezing creates large ice crystals that can damage cell walls and denature proteins. Blast Freezers and Individual Quick Freezers (IQF) rapidly pull the temperature down (e.g., from +20°C to -40°C in minutes). This “flash freezing” preserves the biological integrity of the sample. Rinac’s blast freezers utilize high-velocity airflow and low-temperature coils to achieve this rapid heat exchange.

-

Last-Mile Logistics and Green Transport

The “last mile” remains the most vulnerable link in the Indian cold chain. Transporting a vaccine from a central warehouse in Mumbai to a rural clinic in Bihar involves traversing varied climates and infrastructure qualities.

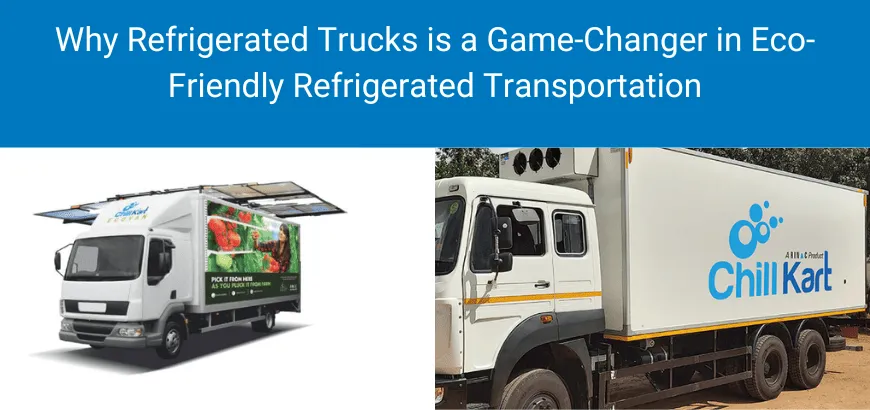

6.1 The Eutectic Revolution: ChillKart

Traditional reefer trucks rely on a secondary diesel engine to run the refrigeration unit. This is noisy, polluting, and prone to failure if the diesel runs out or the engine stalls.

Rinac’s ChillKart represents a paradigm shift toward “stored energy” cooling. It utilizes Eutectic Plates (often called “cool batteries”) containing a Phase Change Material (PCM).

-

Mechanism: The truck is plugged into mains electricity at the warehouse overnight. The PCM plates freeze, storing thermal energy. During the delivery run the next day, the plates slowly release this cold energy to maintain the truck’s internal temperature.

-

Benefits: This system consumes zero diesel for cooling during the delivery. It is silent, emission-free, and has few moving parts, making it highly reliable for rugged rural routes. It can maintain temperatures of -15°C to -25°C for 10–12 hours, sufficient for a full day’s distribution run.

6.2 Solar Integration

For static rural storage, reliability is challenged by power outages. The integration of solar power is becoming a standard specification. Rinac and logistics operators like Coldman are designing cold rooms with roofs capable of supporting solar PV arrays. In some designs, solar power is used during the day to “over-cool” a thermal mass (like an Ice Bank Tank), which then acts as a battery to provide cooling at night or during power cuts.

-

Rinac India Limited: Architectural Role in the Ecosystem

In this complex ecosystem, Rinac India Limited has positioned itself not merely as an equipment vendor, but as a “Solution Architect.” Their portfolio is strategically aligned with the pain points of the 2026 market.

Table 2: Rinac Portfolio Alignment with Market Needs

| Market Challenge | Rinac Solution | Technical Differentiator |

|---|---|---|

| Schedule M Compliance | Clean Modular Construction | PCGI/SS panels, flush joints, coving, FM Approved PIR options. |

| Data Integrity (Audit) | RinCare / Stability Chambers | CFR-21 compliant logging, remote IoT monitoring. |

| Moisture Sensitivity | Low RH Chambers | Dehumidifying coils separate from cooling; precise humidity control. |

| Green Logistics | ChillKart | Eutectic plate technology; zero-emission delivery. |

| Rapid Preservation | Blast Freezers / IQF | High-velocity airflow for rapid pulldown to -40°C. |

| Industrial Scale | Ammonia Systems | High-efficiency natural refrigerant solutions for large warehouses. |

Rinac’s capability to deliver “turnkey” projects—handling everything from the civil floor design to the HVAC, racking, and electricals—simplifies the compliance journey for pharma clients who prefer a single point of accountability for their critical infrastructure.

-

Sustainability and ESG: The Financial & Ethical Imperative

Sustainability in 2026 is driven by a combination of regulatory pressure, corporate Environmental, Social, and Governance (ESG) mandates, and pure financial logic.

8.1 Energy Efficiency as ROI

Cold storage is energy-intensive. With industrial electricity tariffs in India rising, energy efficiency is the primary lever for profitability.

-

ROI of Insulation: While high-quality PUF panels may cost more upfront than masonry or thermocol, the reduction in thermal load can cut energy bills by up to 40%. A detailed lifecycle analysis shows that the Return on Investment (ROI) for premium insulation is often realized within 3-4 years, followed by decades of pure savings.

-

Solar ROI: Companies like Snowman Logistics have demonstrated that rooftop solar can reduce grid energy dependency by 30%, insulating the business from tariff hikes.

8.2 Scope 3 Emissions and the Supply Chain

Major pharmaceutical companies (the customers of logistics firms) have committed to “Net Zero” targets. They are increasingly scrutinizing their Scope 3 emissions—the emissions generated by their supply chain partners. This creates a competitive advantage for logistics providers who use green technologies. A transporter using Rinac’s diesel-free ChillKart trucks can demonstrate a lower carbon footprint per vial of vaccine delivered, making them a preferred partner for global pharma giants.

-

Challenges, Risks, and Mitigation

Despite the robust outlook, the path to 2026 is fraught with challenges.

-

The Skills Gap: The industry faces a shortage of trained technicians. Modern systems using ammonia, advanced automation, and IoT controllers require a different skill set than traditional mechanical refrigeration. There is a risk that sophisticated equipment will be maintained poorly, negating its benefits.

-

Capital Constraints for MSMEs: The cost of upgrading to Schedule M standards and BEE-rated equipment is substantial. Many smaller players may struggle to finance this transition, potentially leading to a consolidation in the industry where only well-capitalized players survive.

-

Infrastructure Deficits: While the “cold” tech is advancing, the “hard” infrastructure—roads and reliable grid power in rural India—remains a variable. The “last mile” will continue to require robust, passive cooling solutions (thermal blankets, high-density insulation) to mitigate these external failures.

-

Conclusion and Strategic Outlook

As India enters 2026, the pharmaceutical cold storage sector is shedding its legacy skin. It is evolving from a fragmented, cost-driven utility into a sophisticated, technology-led, and compliance-focused industry.

The driving forces are clear:

-

Regulatory Compulsion: The Revised Schedule M and BEE norms are non-negotiable filters that will weed out non-compliant infrastructure.

-

Market Demand: The shift to high-value biologics demands precision cooling, not just general refrigeration.

-

Technological Enablement: IoT and AI are providing the visibility required to manage risk in real-time.

For stakeholders across the value chain, the message is consistent: Integrate or Perish.

-

Pharmaceutical Manufacturers must view cold storage not as a warehouse but as a critical quality control node, investing in validation and monitoring.

-

Logistics Providers must pivot to “green” and “smart” fleets to remain eligible for contracts with top-tier pharma clients.

-

Solution Providers like Rinac are pivotal. By bridging the gap between engineering complexity and user compliance, they act as the architects of this new ecosystem.

In 2026, the cold chain is no longer just about keeping things cold; it is about proving they stayed cold, doing so efficiently, and ensuring that the “Pharmacy of the World” delivers on its promise of quality to every patient, from the global metropolis to the rural hinterland.