⚡ TL;DR — Quick Summary

India’s cold chain market is projected to grow from ₹2,287 billion (2024) to ₹6,061 billion by 2033, making cold storage one of the most lucrative agri-business opportunities in the country. The government offers up to ₹10 crore in subsidies under PMKSY and NHB schemes, covering 35–50% of eligible project costs. Starting a cold storage business requires ₹50 lakh to ₹5 crore+ depending on scale, along with FSSAI licensing, proper site selection, and the right cold chain infrastructure partner. This guide covers everything — from market opportunity and government subsidies to equipment selection, licensing, financial planning, and operational best practices for 2026.

📑 Table of Contents

- Why Start a Cold Storage Business in India in 2026?

- India Cold Chain Market Size & Growth Opportunity

- Types of Cold Storage Businesses You Can Start

- Step-by-Step Guide to Starting Your Cold Storage Business

- Government Subsidies & Financial Assistance (2026 Updated)

- Investment & Cost Breakdown

- Choosing the Right Cold Storage Equipment

- Licenses, Permits & Regulatory Compliance

- Best Locations & Site Selection Strategy

- Revenue Model & Profitability Analysis

- Technology Trends Shaping Cold Storage in 2026

- Common Mistakes to Avoid

- Why Partner with Rinac for Your Cold Storage Project

- Frequently Asked Questions (FAQs)

India loses an estimated ₹92,000 crore worth of food annually due to inadequate cold chain infrastructure. For entrepreneurs and agri-business investors, this staggering gap represents one of the most compelling business opportunities of the decade.

With India being the world’s largest producer of milk, the second-largest producer of fruits and vegetables, and a major player in seafood and poultry, the demand for temperature-controlled storage has never been higher. The government’s push through PM Kisan SAMPADA Yojana, the National Horticulture Board (NHB) subsidy scheme, and the newly enhanced ₹6,520 crore allocation for cold chain infrastructure under the 15th Finance Commission cycle makes 2026 the ideal time to enter this space.

Whether you’re a first-generation entrepreneur, an existing food business owner looking to integrate backward, or an investor eyeing the agri-infrastructure sector, this comprehensive guide walks you through every step — from understanding the market and securing subsidies to choosing the right cold chain solutions and building a profitable operation.

1. Why Start a Cold Storage Business in India in 2026?

Several converging factors make 2026 a watershed year for cold storage entrepreneurs in India:

Growing Consumer Demand for Perishables

India’s organised retail sector is projected to reach USD 1 trillion, with consumers increasingly demanding fresh, high-quality perishable products year-round. The quick commerce revolution — led by platforms like Blinkit, Zepto, and Swiggy Instamart — has created explosive demand for localised cold storage near urban consumption centres.

Massive Infrastructure Gap

India faces a cold storage shortfall of approximately 35 million metric tonnes, according to the National Centre for Cold-Chain Development (NCCD). Over 50% of existing cold storage facilities are concentrated in just Uttar Pradesh and West Bengal, leaving vast regions underserved. Most existing facilities are single-commodity (primarily potato) stores, while the market desperately needs multi-commodity cold storage solutions.

Government’s Strongest-Ever Policy Support

In July 2025, the Union Cabinet approved an additional ₹1,920 crore for PMKSY, raising the total allocation to ₹6,520 crore. This includes ₹1,000 crore specifically for Food Irradiation Units under the Integrated Cold Chain and Value Addition Infrastructure (ICCVAI) scheme. The subsidy coverage ranges from 35% to 50% of eligible project costs.

Export Opportunities

India’s agricultural export ambitions — particularly in seafood, fruits, and processed foods — are directly tied to cold chain capability. Export-grade facilities with IQF (Individual Quick Freezing) systems and HACCP-compliant infrastructure command premium rental rates and long-term contracts.

2. India Cold Chain Market Size & Growth Opportunity

The numbers tell a compelling story for anyone considering a cold storage business in India:

📊 Key Market Statistics (2024–2033)

- India cold chain market size (2024): ₹2,287 billion (~USD 10.5 billion)

- Projected market size (2033): ₹6,061 billion (~USD 74.5 billion)

- CAGR: 10.86% to 24.7% (depending on segment)

- Cold storage segment (2024): USD 6.54 billion, projected to reach USD 18.26 billion by 2030

- Current cold storage capacity: ~6,300 facilities with 30.11 million MT installed capacity

- Annual infrastructure investment needed: ₹25,000 crore (~USD 3 billion)

The fastest-growing segments include pharmaceutical cold chain (driven by biologics and vaccine distribution), frozen food and ready-to-eat meals, quick commerce dark store infrastructure, and export-oriented seafood and meat processing. East India is emerging as the fastest-growing region for cold chain logistics, supported by Kolkata port connectivity and expansion in fisheries across Odisha and West Bengal.

3. Types of Cold Storage Businesses You Can Start

Before investing, it’s essential to understand the different cold storage business models available. Each serves a specific market need and has different capital requirements.

3.1 Multi-Commodity Cold Warehouse

These are large-scale facilities designed to store multiple products — fruits, vegetables, dairy, meat, and pharmaceuticals — at varying temperature zones. They offer the highest revenue potential through diversified rental income streams. Modular cold rooms from established providers allow you to create multiple temperature zones within a single facility, ranging from +15°C to -40°C.

- Investment range: ₹2 crore to ₹10 crore+

- Best for: Agricultural hubs, food processing zones, logistics parks

3.2 Single-Commodity Cold Store

Focused on one product category — commonly potatoes, onions, or apples. Simpler to operate but carries seasonal utilisation risk. These dominate India’s current cold storage landscape but are gradually being replaced by multi-commodity models.

- Investment range: ₹50 lakh to ₹3 crore

- Best for: Agricultural regions with dominant single-crop production

3.3 Ripening & Pack House Facility

Specialised units with ripening chambers, sorting and grading lines, and pre-cooling rooms. Ideal for fruits like bananas, mangoes, and avocados, where controlled ripening directly impacts market price realisation.

- Investment range: ₹1 crore to ₹5 crore

- Best for: Fruit-growing regions, mandis, export hubs

3.4 Frozen Food Processing & Storage

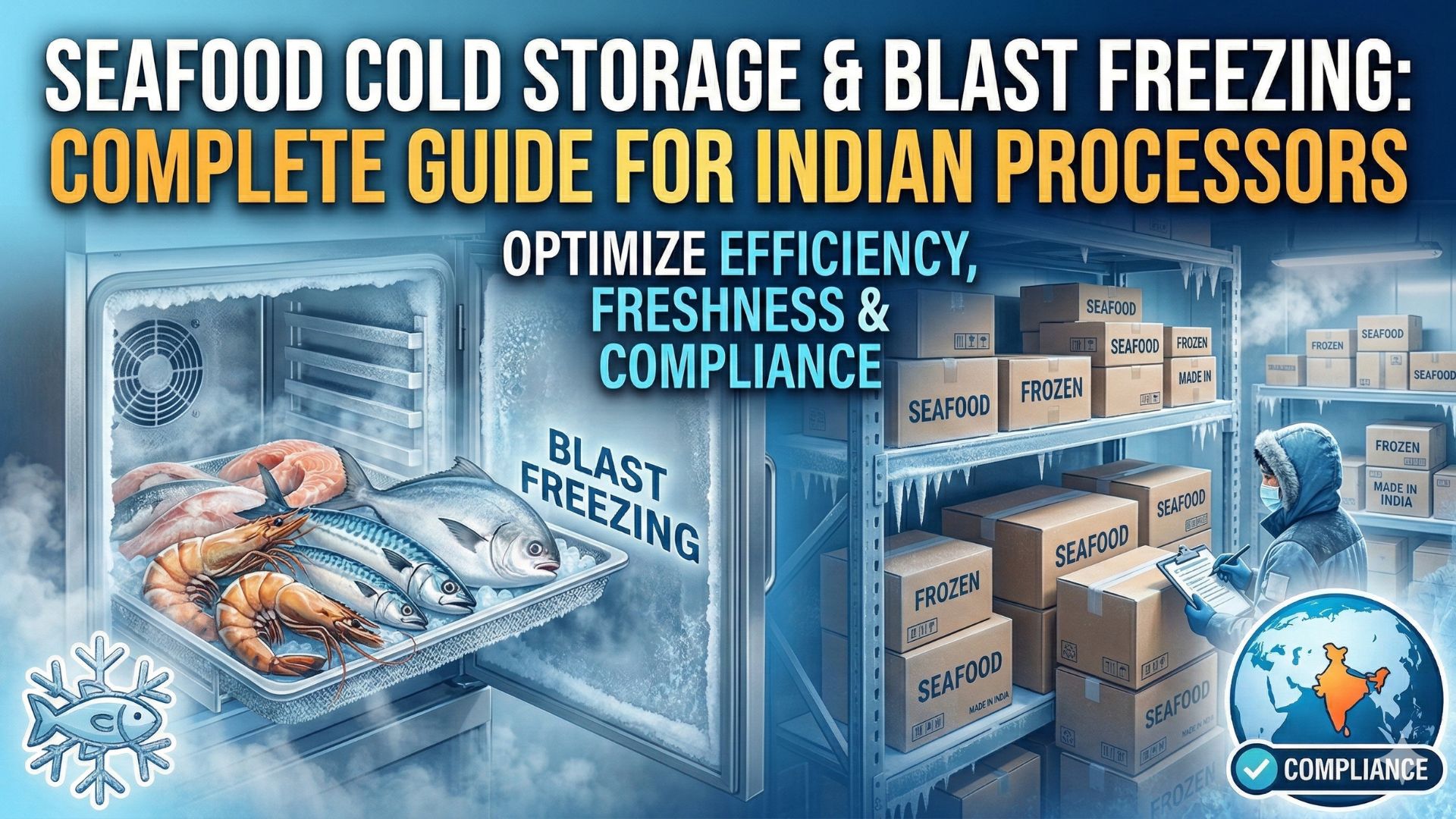

Combines processing capabilities (using blast freezers and IQF systems) with deep-frozen storage. High-value model especially for seafood, poultry, ready-to-eat meals, and frozen fruits and vegetables.

- Investment range: ₹3 crore to ₹15 crore+

- Best for: Coastal regions, poultry hubs, food processing zones

3.5 Pharma-Grade Cold Storage

Temperature-controlled facilities built to WHO-GMP and GDP standards for pharmaceutical products, vaccines, and biologics. Requires precision humidity control, validated temperature mapping, and comprehensive monitoring systems. Smaller in volume but delivers disproportionately high margins.

- Investment range: ₹2 crore to ₹8 crore

- Best for: Pharmaceutical manufacturing clusters, metro cities

3.6 Last-Mile / Micro Cold Storage

Compact, modular units like Rinac’s PreServa walk-in cold rooms placed at mandis, retail clusters, and quick commerce dark stores. Lower investment, faster payback, ideal for first-time entrepreneurs.

- Investment range: ₹10 lakh to ₹50 lakh

- Best for: Urban and peri-urban areas, retail clusters, FPOs

4. Step-by-Step Guide to Starting Your Cold Storage Business

Step 1: Market Research & Feasibility Study

Before investing a single rupee, conduct thorough research on your target market:

- Identify the top perishable commodities produced or consumed in your target area

- Map existing cold storage facilities and their utilisation rates within a 50 km radius

- Survey potential customers — farmers, FPOs, food processors, retailers, pharma companies

- Assess seasonal demand patterns to project year-round utilisation

- Study regional crop calendars and harvest timelines to plan capacity

Step 2: Prepare a Detailed Project Report (DPR)

A well-structured DPR is essential for both bank financing and government subsidy applications. Your DPR should include:

- Project overview, promoter background, and business entity structure

- Technical specifications — storage capacity, temperature zones, equipment details

- Market analysis and demand projections with supporting data

- Financial projections — capital expenditure, revenue model, operating costs, ROI timeline

- Land details, layout plans, and civil engineering specifications

- Means of finance — promoter equity, bank loan, and government subsidy components

Step 3: Secure Land & Location

Your site selection directly impacts operational costs and revenue potential. Key considerations include proximity to production zones or consumption centres, road connectivity, uninterrupted power supply, water availability, and zoning approvals. See our detailed location strategy section below.

Step 4: Choose Your Business Structure

Register your business as one of the following:

- Private Limited Company — best for attracting investors and scaling operations

- Limited Liability Partnership (LLP) — flexibility with limited liability protection

- Proprietorship or Partnership — simpler setup for smaller operations

- FPO / Cooperative — eligible for higher subsidy rates (up to 50%) in some schemes

Step 5: Apply for Government Subsidies

File your subsidy applications early through the SAMPADA portal (MoFPI) or NHB. The subsidy process involves Expression of Interest (EOI) submission, DPR evaluation, in-principle approval, phased disbursement linked to project milestones, and final commissioning verification. See Section 5 for complete details on available schemes.

Step 6: Arrange Financing

A typical financing structure for a cold storage project looks like:

- Promoter equity: 15–25% of total project cost

- Term loan: 40–50% from banks (NABARD refinancing available)

- Government subsidy: 35–50% of eligible costs

Banks like SBI, Bank of Baroda, PNB, and NABARD have dedicated cold chain financing programs. Several state-level schemes also offer interest subvention on term loans.

Step 7: Select Your Infrastructure Partner & Equipment

This is arguably the most critical decision. Your cold storage infrastructure partner should offer end-to-end turnkey solutions — from design and engineering through installation and commissioning — to ensure your facility meets technical standards required for subsidy compliance and operational efficiency.

Step 8: Civil Construction & Equipment Installation

Once approvals are in place, begin construction. A modular approach using pre-fabricated insulated panel systems significantly reduces construction time (30-40% faster than conventional methods) and ensures superior thermal performance.

Step 9: Obtain All Required Licenses

Complete all regulatory requirements including FSSAI license, electrical safety certification, pollution control board NOC, and fire safety clearance. See Section 8 for the complete checklist.

Step 10: Commissioning, Testing & Launch

After installation, thorough commissioning includes temperature mapping, humidity validation, equipment performance testing, and safety system verification. Only after successful commissioning should you onboard your first clients.

5. Government Subsidies & Financial Assistance (2026 Updated)

India offers some of the most generous cold chain subsidies in the world. Here are the major schemes available in 2026:

5.1 PMKSY — Integrated Cold Chain & Value Addition Infrastructure (ICCVAI)

- Administered by: Ministry of Food Processing Industries (MoFPI)

- Total allocation (2025–26 cycle): ₹6,520 crore

- Grant coverage: 35% of eligible project cost in general areas; 50% in difficult areas (NE states, J&K, Himachal Pradesh, Uttarakhand, ITDP areas, Islands)

- Maximum grant: Up to ₹10 crore

- Mandatory requirement: Farm Level Infrastructure (FLI) connected to Distribution Hub and/or refrigerated transport

- Eligible applicants: Individuals, FPOs, FPCs, NGOs, PSUs, Companies, Cooperatives, SHGs

- Application portal: sampada.mofpi.gov.in

5.2 NHB — Capital Investment Subsidy for Cold Storage

- Administered by: National Horticulture Board

- Subsidy rate: 35% credit-linked back-ended subsidy in general areas; 50% in NE, hilly, and scheduled areas

- Eligible capacity: Cold storage and CA storage from 5,000 MT to 20,000 MT

- Covers: Construction, expansion, and modernisation of cold storage and Controlled Atmosphere (CA) storage facilities

5.3 MIDH — Mission for Integrated Development of Horticulture

Provides financial assistance for cold chain infrastructure specifically linked to horticulture produce, covering pre-cooling units, cold rooms, CA/MA chambers, and refrigerated transport.

5.4 State-Level Schemes

Many states offer additional subsidies and incentives. Key ones include:

- Gujarat: Capital subsidy through iKhedut portal for agricultural cold chain

- Punjab & Haryana: State-level MoFPI scheme implementation with additional incentives

- Andhra Pradesh & Telangana: Cold chain subsidy under state horticulture missions

- Maharashtra: Food processing incentives under industrial policy

Pro Tip: Working with a turnkey cold chain provider like Rinac India Limited — which has executed projects under the MOFPI APC Scheme — ensures your facility design and equipment specifications meet the technical standards required for subsidy approvals.

6. Investment & Cost Breakdown

Here’s a realistic breakdown of costs for different cold storage business scales in India:

Small-Scale Cold Storage (500–1,000 MT Capacity)

| Cost Component | Estimated Cost (₹) |

|---|---|

| Land (leased or owned) | ₹20–50 lakh |

| Civil construction / Pre-fabricated structure | ₹30–80 lakh |

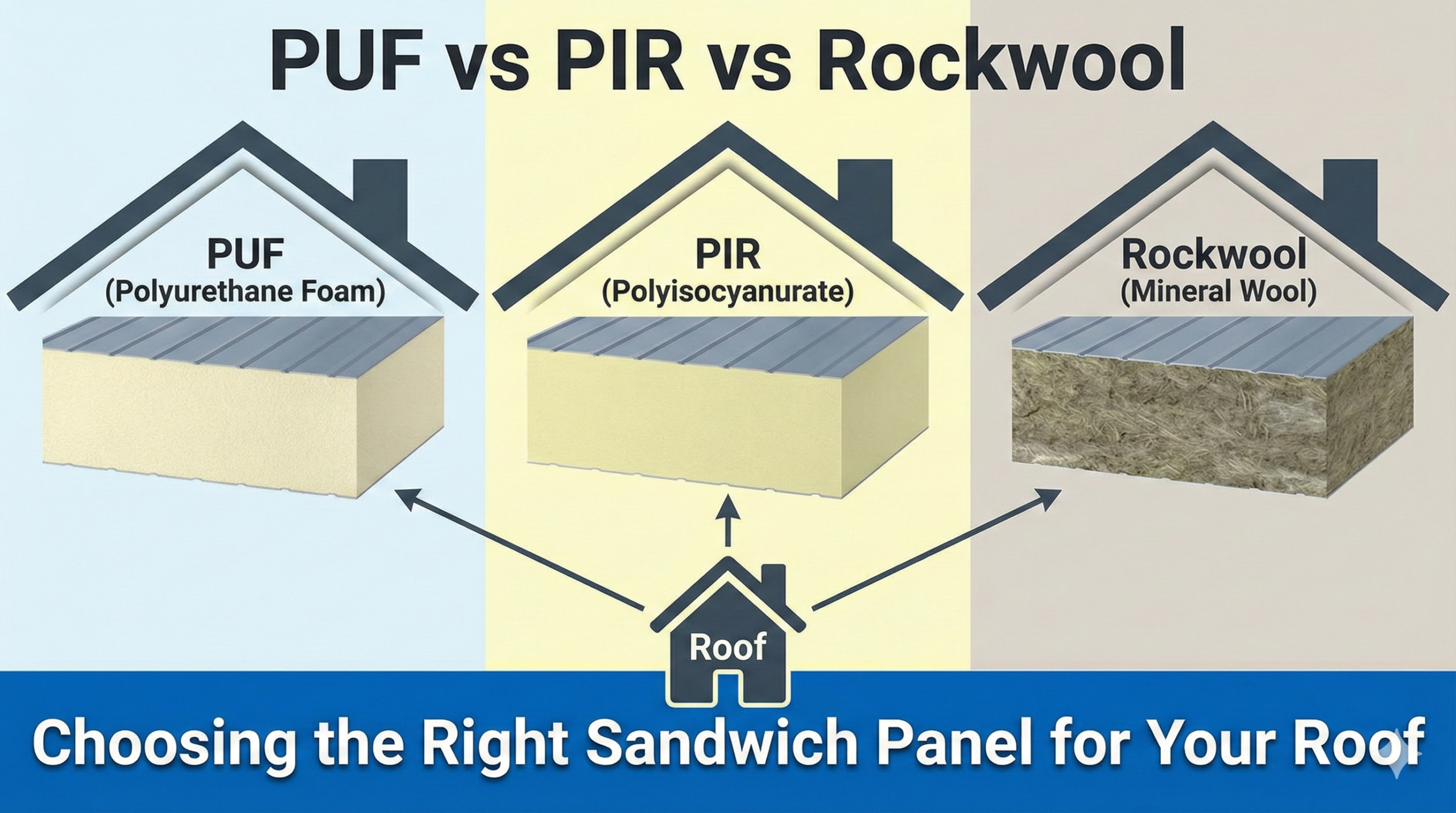

| Insulated panels (PUF/PIR), doors, flooring | ₹25–60 lakh |

| Refrigeration system & installation | ₹30–70 lakh |

| Racking & material handling | ₹10–25 lakh |

| Electrical, DG set, power backup | ₹15–30 lakh |

| Licensing, consulting & working capital | ₹10–20 lakh |

| Total Estimated Investment | ₹1.4 – 3.35 crore |

Medium-Scale Multi-Commodity Cold Storage (2,000–5,000 MT)

For a medium-scale multi-commodity facility, expect a total project cost of ₹3 crore to ₹8 crore, with the refrigeration system and insulated panel structure forming the largest cost components (typically 40–50% of total cost).

Large-Scale Integrated Cold Chain Facility (5,000–20,000 MT)

A fully integrated facility with processing, storage, and logistics capabilities requires an investment of ₹8 crore to ₹25 crore+. These projects qualify for the maximum government subsidy of ₹10 crore and offer the highest long-term returns through diversified revenue streams.

Monthly Operating Costs (Mid-Size Facility)

- Electricity: ₹2–5 lakh/month (the single largest operational expense)

- Manpower: ₹1–3 lakh/month (5–15 staff)

- Maintenance: ₹50,000–1.5 lakh/month

- Insurance: ₹25,000–75,000/month

- Miscellaneous: ₹50,000–1 lakh/month

7. Choosing the Right Cold Storage Equipment

The equipment you select directly impacts operational efficiency, energy costs, food safety compliance, and long-term profitability. Here’s what you need to consider for each major component:

7.1 Insulated Panels (PUF / PIR)

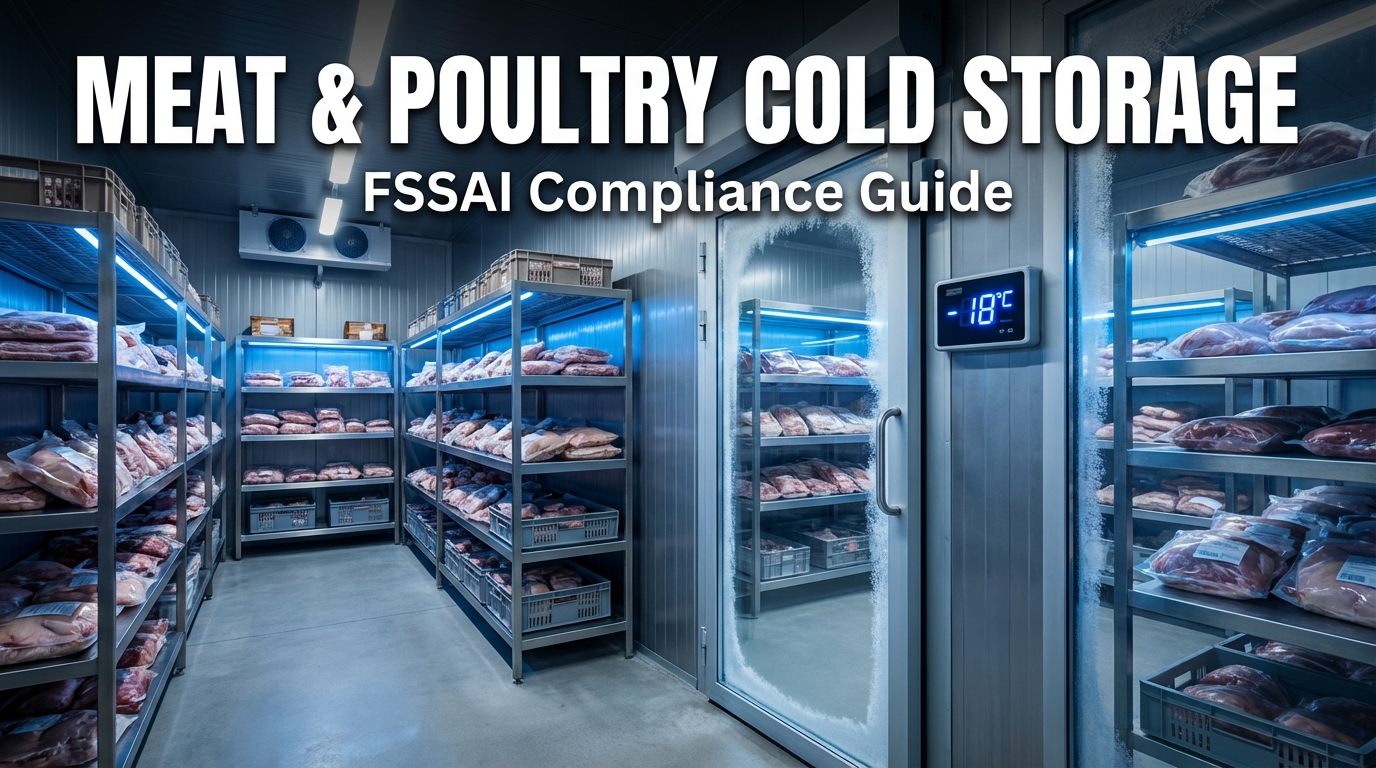

High-density polyurethane foam (PUF) or polyisocyanurate (PIR) insulated sandwich panels form the thermal envelope of your cold storage. The panel thickness, U-value, and joint design determine energy efficiency and temperature stability. Look for panels that meet fire resistance standards and offer food-safe interior coatings. Learn how modular cold storage can be customised for varying temperature needs.

7.2 Refrigeration Systems

The heart of your cold storage. Modern refrigeration systems use ammonia (NH3) or HFC refrigerants depending on plant size and safety requirements. Key considerations:

- Compressor type and capacity at design ambient temperature

- Energy efficiency ratings and part-load performance

- Redundancy strategy (N+1 for critical applications)

- Automation and remote monitoring capabilities

- Compliance with India’s regulations on refrigerant phasedown

7.3 Cold Rooms — Walk-In Chillers & Freezers

Walk-in chillers maintain temperatures between -2°C and 5°C for fresh produce, dairy, and pharmaceuticals. Walk-in freezers operate at -18°C to -25°C for long-term frozen storage. For smaller operations, MRW Series walk-in cold rooms offer a cost-effective, modular solution.

7.4 Blast Freezers & Chillers

Essential for food processing businesses. Blast freezers rapidly reduce product temperature from +90°C to -18°C within 240 minutes, preventing bacterial growth and preserving quality. Available in capacities from 50 kg to 3,000 kg per batch. Read the complete guide to blast freezers and chillers.

7.5 IQF (Individual Quick Freezing) Systems

For export-oriented businesses, IQF freezers are indispensable. They freeze each product individually — berries, shrimp, chicken pieces, peas — without clumping, preserving texture, flavour, and nutritional value. Rinac offers both straight belt and spiral belt IQF systems with capacities from 500 to 5,000 kg/hr. Learn how IQF technology works.

7.6 CA/MA Chambers

Controlled Atmosphere (CA) and Modified Atmosphere (MA) chambers extend the shelf life of fruits, vegetables, and grains by regulating oxygen, carbon dioxide, and nitrogen levels. These are particularly valuable for apple storage in Himachal Pradesh and Jammu & Kashmir, and for onion/potato storage across major producing states.

7.7 Ripening Chambers

Ripening chambers ensure uniform, controlled ripening of fruits like bananas, mangoes, papayas, and avocados using ethylene gas management and precise temperature/humidity control. Uniform ripening significantly improves market price realisation.

7.8 Refrigerated Transport

Last-mile cold chain integrity depends on refrigerated containers for vehicles. Rinac’s ChillKart range includes eutectic (PCM-based) reefer containers that offer energy-efficient, emission-free refrigerated transport — ideal for urban delivery and short-haul logistics.

8. Licenses, Permits & Regulatory Compliance

Here is the comprehensive checklist of licenses and permits you’ll need:

8.1 Mandatory Licenses

| License / Permit | Issuing Authority | Est. Fee / Timeline |

|---|---|---|

| Business Registration (Company/LLP/Firm) | MCA / Registrar of Firms | ₹5,000–15,000 / 7–15 days |

| GST Registration | GST Portal | Free / 3–7 days |

| FSSAI License (State or Central) | FSSAI (FoSCoS Portal) | ₹2,000–7,500/year / 30–60 days |

| Pollution Control NOC (Consent to Establish & Operate) | State Pollution Control Board | Varies by state / 30–90 days |

| Fire Safety NOC | State Fire Department | Varies / 15–30 days |

| Electrical Safety Approval | State Electrical Inspectorate | Varies / 15–30 days |

| Shop & Establishment License | Local Municipal Authority | ₹500–5,000 / 7–15 days |

| MSME / Udyam Registration | Udyam Portal (MSME Ministry) | Free / Instant |

8.2 FSSAI License Details for Cold Storage

Cold storage facilities require a State FSSAI License (for turnover up to ₹20 crore) or Central FSSAI License (for turnover above ₹20 crore or multi-state operations). The State License fee ranges from ₹2,000 to ₹5,000 per year, while the Central License costs ₹7,500 per year. Applications are filed through the FoSCoS portal.

8.3 Additional Certifications (Recommended)

- ISO 22000 / HACCP: Food safety management — increasingly required by large clients

- ISO 9001: Quality management system

- WHO-GMP: Mandatory for pharma-grade cold storage

- IGBC Green Building Certification: Differentiator for sustainability-conscious clients

- APEDA Registration: Required if handling export-bound agricultural products

9. Best Locations & Site Selection Strategy

Site selection can make or break your cold storage business. Here are the key factors and top regions to consider:

9.1 Critical Site Selection Criteria

- Proximity to production/consumption: Within 25–50 km of major agricultural production zones, food processing clusters, mandis, or urban consumption centres

- Power infrastructure: Reliable electricity supply is non-negotiable (electricity is 40–60% of operating costs). Proximity to substations and backup power provisions are critical

- Road connectivity: Access to national highways and state highways for efficient inbound/outbound logistics

- Land availability & zoning: Industrial-zoned land with clear title. Agricultural land conversion may be needed in some states

- Water availability: Required for condensers, cleaning, and processing areas

- Labour availability: Proximity to skilled and semi-skilled workforce

9.2 Top States for Cold Storage Investment in 2026

| State / Region | Key Commodities | Opportunity |

|---|---|---|

| Andhra Pradesh & Telangana | Poultry, seafood, mangoes, chillies | Largest poultry producer; growing seafood exports |

| Tamil Nadu & Karnataka | Fruits, vegetables, dairy, pharma | Major food processing hubs; pharma cold chain demand |

| Maharashtra | Grapes, onions, dairy, processed foods | Export hub; JNPT proximity; growing frozen food demand |

| Gujarat | Dairy, fruits, cotton-seed oil | Strong dairy cooperative ecosystem; GIFT/DMIC corridor |

| Uttar Pradesh | Potato, mango, dairy | Largest existing capacity but modernisation opportunity |

| Odisha & West Bengal | Seafood, rice, vegetables | Fastest-growing eastern region; fisheries expansion |

| North-East India | Pineapple, orange, ginger, spices | 50% subsidy in difficult areas; virtually no competition |

10. Revenue Model & Profitability Analysis

10.1 Primary Revenue Streams

- Storage rental: Charged per MT per month (₹150–500/MT/month for general cold storage; ₹800–2,000+ for pharma-grade)

- Processing fees: Blast freezing, IQF, ripening, sorting & grading services

- Value-added services: Packaging, labelling, quality testing

- Handling charges: Loading, unloading, inventory management

- Long-term contracts: Dedicated space leasing to food processors, pharma companies, retail chains

10.2 Profitability Indicators

- Target utilisation rate: 65–80% (year-round, across seasons)

- Operating margin: 15–25% for well-managed multi-commodity facilities

- Payback period: 4–7 years (with subsidy); 6–10 years (without subsidy)

- ROI: 18–30% post-stabilisation (year 3 onwards)

10.3 Key Success Factor: Year-Round Utilisation

The biggest risk to profitability is seasonal idling. Single-commodity facilities (especially potato stores) may operate at 80%+ capacity for just 4–5 months and sit idle the rest of the year. Multi-commodity facilities with diversified storage — such as combining fruits & vegetables with dairy, meat, and pharma — can maintain 70–85% utilisation year-round, dramatically improving unit economics.

11. Technology Trends Shaping Cold Storage in 2026

11.1 IoT-Enabled Temperature Monitoring

Real-time temperature and humidity monitoring through IoT sensors with cloud-based dashboards and mobile alerts is becoming standard. This ensures compliance with FSSAI and HACCP requirements while reducing spoilage and insurance costs.

11.2 Solar-Powered Cold Storage

With electricity being the largest operating cost, solar-powered and hybrid cold storage systems are gaining rapid traction. The government is incentivising renewable energy adoption in logistics through allocations of approximately ₹10,000 crore towards renewable energy in the logistics sector.

11.3 AI & Machine Learning for Predictive Operations

AI-based routing for reefer logistics, predictive maintenance for refrigeration equipment, and demand forecasting for capacity planning are transforming how cold storage facilities operate. Operators using AI-driven systems report 15–20% reduction in energy costs.

11.4 Automated Storage & Retrieval Systems (AS/RS)

For large-scale operations, AS/RS reduces manual handling in sub-zero environments, improves storage density by up to 40%, and enhances inventory accuracy to near-100%.

11.5 Green Refrigerants & Energy-Efficient Systems

India’s commitment to phasing down HFCs under the Kigali Amendment is driving adoption of natural refrigerants (ammonia, CO2) and high-efficiency compressor systems. Modern systems from providers like Rinac integrate energy-efficient compressors, optimised insulation, and advanced controls to minimise energy consumption.

12. Common Mistakes to Avoid

Learning from the failures of others can save you crores. Here are the most common pitfalls:

- Building a single-commodity facility: Over-reliance on one crop (especially potatoes) leads to severe seasonal underutilisation. Always plan for multi-commodity capability.

- Underestimating power costs: Electricity is 40–60% of operating expenses. Factor in DG backup costs, power tariff escalation, and consider solar integration from day one.

- Choosing cheap equipment over reliable equipment: Low-cost refrigeration and panels lead to frequent breakdowns, temperature excursions, product losses, and higher long-term costs. Partner with an established provider with proven after-sales support.

- Ignoring location fundamentals: Building in a remote area with poor road access or unreliable power negates any land cost savings.

- Poor DPR preparation: A weak DPR leads to subsidy rejection and loan denial. Invest in professional DPR preparation.

- Neglecting maintenance: Cold storage equipment requires regular preventive maintenance. Skipping maintenance leads to breakdowns that can destroy stored goods worth crores. Consider an Annual Maintenance Contract (AMC) with your equipment provider.

- Not planning for expansion: Build with modular systems that allow future capacity expansion without overhauling existing infrastructure.

- Inadequate insurance: Insure your facility and stored goods against equipment failure, power outages, natural disasters, and third-party liability.

13. Why Partner with Rinac for Your Cold Storage Project

Starting a cold storage business is a significant investment, and your infrastructure partner’s expertise directly determines your project’s success. Rinac India Limited, established in 1994, brings nearly three decades of specialised cold chain expertise to the table.

What Sets Rinac Apart:

- End-to-End Turnkey Solutions: From land acquisition assistance and design-build to equipment supply, installation, commissioning, and after-sales service — everything under one roof

- In-House Manufacturing: Four state-of-the-art manufacturing units (Bangalore and Mumbai) producing PUF/PIR insulated panels, cold room doors, refrigeration systems, and modular construction components — ensuring quality control and faster delivery

- Comprehensive Product Portfolio: From modular cold rooms and blast freezers to IQF systems, ripening chambers, CA/MA chambers, and refrigerated transport solutions

- Subsidy-Compliant Designs: Proven track record of executing projects under MOFPI APC Scheme and other government programs, with facility designs that meet all technical standards required for subsidy approvals

- Trusted by Industry Leaders: Clients include ITC, Britannia, Tata, Reliance, Nestlé, Flipkart, Biocon, Pepsico, Haldiram’s, Patanjali, Heritage, and hundreds more

- Pan-India Presence: 13 branch offices across India with international operations in 23+ countries

- Innovation Leaders: 5 patents awarded with 3 more in pipeline. Indigenous innovations include India’s first modular cold room, first spiral IQF, and the ChillKart eutectic transport range

- Certifications: ISO 9001, ISO 14001, ISO 45001, FSSAI, HACCP, GMP, and IGBC certified

- After-Sales Support: Comprehensive O&M services including AMC (Annual Maintenance Contracts), ALC (Annual Labour Contracts), periodic health checks, and remote monitoring

Ready to Start Your Cold Storage Project?

Get a free consultation and customised project proposal from Rinac’s cold chain experts.

14. Frequently Asked Questions (FAQs)

Q1: How much investment is needed to start a cold storage business in India?

A small-scale cold storage (500–1,000 MT) requires approximately ₹1.5 crore to ₹3.5 crore. A medium-scale multi-commodity facility (2,000–5,000 MT) costs ₹3–8 crore. Large-scale integrated cold chain facilities with processing capabilities can require ₹8–25 crore or more. Government subsidies can cover 35–50% of eligible project costs, significantly reducing the net investment.

Q2: What is the government subsidy available for cold storage in India in 2026?

The primary schemes are the PMKSY-ICCVAI scheme (up to ₹10 crore grant, covering 35% in general areas and 50% in difficult areas) administered by MoFPI, and the NHB Capital Investment Subsidy (35% credit-linked subsidy in general areas, 50% in NE/hilly areas) for cold storage capacities of 5,000–20,000 MT. The total PMKSY allocation stands at ₹6,520 crore for the current Finance Commission cycle.

Q3: What licenses are required to operate a cold storage business in India?

Key licenses include FSSAI License (State or Central depending on turnover), GST Registration, Pollution Control Board NOC (Consent to Establish & Operate), Fire Safety NOC, Electrical Safety Approval, Shop & Establishment License, and MSME/Udyam Registration. For food export-oriented facilities, APEDA registration is also required.

Q4: Is cold storage business profitable in India?

Yes, a well-planned multi-commodity cold storage business can deliver operating margins of 15–25% and an ROI of 18–30% post-stabilisation. The payback period is typically 4–7 years with government subsidy and 6–10 years without. The key to profitability is maintaining year-round utilisation above 65% by serving multiple commodity types and customer segments.

Q5: What is the best type of cold storage to start in India?

For first-time entrepreneurs, a multi-commodity cold storage facility is recommended over single-commodity stores because it ensures year-round utilisation and diversified revenue streams. If you have limited capital, starting with a compact modular walk-in cold room for last-mile storage at a mandi or retail cluster can be a lower-risk entry point.

Q6: What temperature ranges are required for different products?

Common temperature ranges include: fruits and vegetables (+2°C to +8°C), dairy products (0°C to +4°C), frozen foods (-18°C to -25°C), pharmaceuticals (+2°C to +8°C for most drugs), ice cream (-25°C to -30°C), and meat/seafood (-18°C to -30°C). Rinac’s cold rooms support temperatures from +15°C to -40°C to cover virtually all storage needs.

Q7: How long does it take to set up a cold storage facility?

A typical cold storage project takes 6–12 months from DPR preparation to commissioning. Using modular, pre-fabricated construction from providers like Rinac can reduce construction timelines by 30–40% compared to conventional methods. Subsidy application and approval can add 3–6 months to the overall timeline.

Q8: Can I start a cold storage business in a rural area?

Absolutely. In fact, rural locations near agricultural production zones often have lower land costs and are closer to the farm-level supply chain. The government specifically encourages farm-level cold chain infrastructure (FLI) as a mandatory component under the PMKSY-ICCVAI scheme. Facilities in difficult/rural areas can access the higher 50% subsidy rate.

Q9: What is the electricity consumption of a cold storage facility?

Electricity is the largest operating expense, typically accounting for 40–60% of monthly costs. A 1,000 MT cold storage can consume 50,000–1,00,000 units per month depending on ambient temperature, storage temperature, and equipment efficiency. Using energy-efficient refrigeration systems with modern compressors and optimised insulation panels can reduce consumption by 20–30%.

Q10: Who can help me set up a turnkey cold storage project in India?

Rinac India Limited is one of India’s leading turnkey cold chain infrastructure providers with nearly 30 years of experience. They offer end-to-end solutions covering design, engineering, manufacturing, installation, commissioning, and after-sales service. With four manufacturing units, 13 branches across India, and clients including major names like ITC, Britannia, Reliance, and Nestlé, Rinac has the expertise to take your project from concept to commissioning